Depressed December new-vehicle sales may have automakers facing a blue Christmas, but retailers are seeing record high transaction prices.

That’s the takeaway from two new reports from J.D. Power and TrueCar. And unlike previous years, don’t expect a big sales blowout to clear the lots.

“Historically, December is a big month for the industry as OEMs and dealerships work to close out the calendar year with strong sales. The last week of the month is also typically the biggest week of the year in terms of sales volumes but it’s unlikely to happen this year due to continued inventory shortages and declining incentives,” said Nick Woolard, lead industry analyst at TrueCar.

December retail sales decline from 2020

A joint forecast from J.D. Power and LMC Automotive forecasts new vehicle retail sales this of 1,105,800 units this month. That’s a 17.4% decrease compared with December 2020, when adjusted for selling days. (This year has one fewer sales day than last year.) Without the adjustment, year-over-year sales dropped 20.4% in 2020.

Similarly, TrueCar predicts U.S. retail deliveries of new cars and light trucks to be 1,024,263 units, down 27% from a year ago and on par with November 2021.

That number excludes fleet sales. Fleet sales are even more depressed, according to TrueCar. The expectation for December 2021 is a 29% decrease in sales from a year ago and decline of 3% from November 2021 when adjusted for the same number of selling days.

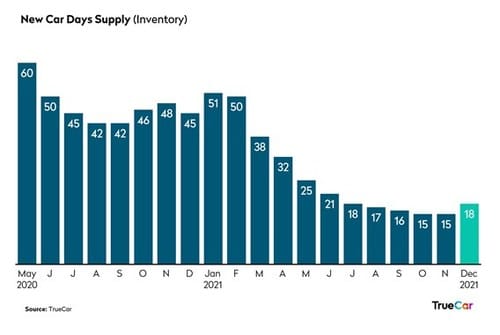

Vehicles continue to be in short supply, with nearly 57% of vehicles selling within 10 days of arriving at a dealership. That’s a record, according to J.D. Power, which notes that vehicles remain on dealer lots for a mere 17 days, a record low, and down from 49 days a year ago. TrueCar pegs that number at 18 days, up from previous months, but still near historic lows.

Short supply fueling higher prices

The short supply of new vehicles is leading to higher average transaction prices.

“While the inventory situation has improved modestly since November, supply remains well below the level at which consumer demand for new vehicles can be met. Intense demand with this limited supply is resulting in prices continuing to increase,” said Thomas King, president of the data and analytics at J.D. Power.

King notes average transaction prices are expected to reach a record $45,743 this month, 20% higher than December 2020 and the first time that number has passed $45,000.

The higher prices are the result of reduced incentive spending by OEMs, with the average manufacturer incentive per vehicle totaling $1,598, a decrease of $2,291 from a year ago. That’s 3.5% of the average vehicle MSRP, down from almost 5.5% a year ago, according to King.

TrueCar’s forecast a similar story, with automaker incentive spending down 55%. This is leading to an average transaction price projected to increase 7.5% from December 2020 and rise 2.5% from November 2021.

Incentive spending is tumbling, according to TrueCar. Year over year, General Motors cut its incentive spending 64.7%, the most of any automaker. Nissan cut its spending 57%, Hyundai 54%, Toyota 53.5%, Volkswagen Group 51.35%, BMW 47.3%, Stellantis 46.5%, Ford 41.8%, Kia 41.6%, Honda 40.9%, Daimler 37% and Subaru 31.9 percent. Subaru was lowest by dollar amount of the OEMs examined at $1,006. Daimler was the highest at $2,738.

Who’s benefitting most? Retailers

But retailers are benefitting from current market conditions. Although volume is lower, Dealers’ profit per unit — inclusive of grosses and finance & insurance income — is forecast to hit a record $5,258, up from $3,277 from a year ago. This has led to record dealer profits, which are projected to be up 254% from December 2019, reaching an industry aggregate revenue of $5.8 billion — an industry record.

And the strong vehicle demand for new vehicles is fueling record used vehicle prices, which is giving buyers more equity on their trade-ins, with the average trade-in equity for December expected to reach $10,199, up from $4,623 from a year ago, and an 83% increase. That increased equity helps make pricier vehicles more affordable, as has a decrease in the average interest rate in December. It’s expected to decline nine basis points to 4.05 percent.

But increased equity and lower interest rates hasn’t helped fitting a car payment into the family budget. The average new vehicle payment is expected to reach $680, up $78 from December 2020, and a record high, according to Power. TrueCar paints a similar picture, with the average interest rate on new vehicles is 4.3% and the average interest rate on used vehicles is 7.5%. The average loan term for both new and used vehicles is 70 months.

2022 should be better than 2021

When it comes time total calendar year sales, expectations are for an improvement from 2020.

“Full year 2021 will still show a solid sales increase from 2020. The year-over-year sales declines experienced every month in the second half of 2021 were not enough to wash the record sales pace in the first half of the year,” King said.

But it should improve during the next 12 months.

“Indications are that shipments will rise incrementally as the year goes on, allowing sales to rise from 2021 levels. However, pent-up consumer demand will keep inventory levels near historical lows,” King said.

TrueCar also sees inventories improving, but incrementally.

“We continue to see signals of stability and in some cases, slight improvement. One such indicator, our scarcity measure, shows improvement in recent months for both new and used vehicles,” said Valeri Tompkins, senior vice president of OEM Solutions at TrueCar. “However, questions still remain as to the trajectory of improvement we can expect to see in 2022.”

For GREAT deals on a new or used Nissan check out McPhillips Nissan TODAY!